VAT in Poland: Rates, Number, Registration

VAT in Poland is a tax on goods and services paid by businesses operating in Poland calculated on the basis of purchase and sale transactions. Business entities pay VAT on goods purchased to the seller, who then transfers the value of the tax to the Tax Office.

Article 5 of the VAT Act lists a number of activities that should be taxed with VAT, including paid delivery of goods and services within the country, export of goods, intra-Community acquisition and delivery of goods.

VAT is obligatory in Poland for entrepreneurs who sell goods or services listed in the VAT Act, or the value of their sales exceeds 200,000 Polish Złoty in any year. A company that issues invoices for amounts over PLN 15,000 should be aware of the concept of split payment mechanism, and how it can obtain a VAT refund.

In order to calculate the value of VAT, multiply the net price and the VAT rate. For example, for a purchase worth 1,000 Polish Złoty net multiply it by 23% of the default VAT rate resulting in 230 PLN of VAT due.

Table of Contents

What is the VAT rate in Poland?

The VAT rate in Poland is set for 23% by default. Does Poland have a reduced VAT rate? Yes, the reduced VAT rate of 8% applies to services related to culture, sports and recreation, goods used in agriculture, such as seeds and grains, goods related to health care, such as medical devices and disinfectants, food goods like coffee, cocoa, and sauces. The second reduced VAT rate of 5% applies to basic food products such as bread and dairy products, baby products and books, among others.

Temporary reductions in VAT rates were additionally introduced in Poland. The most important reductions in Polish VAT in 2022 are lowering VAT for fuel from 23% to 8%, and for electricity from 23% to 5%. Reduced VAT rates of 0% in 2023 applies to basic food products, such as meat, dairy products, flour, vegetables and fruits that were taxed 5% before. In addition, in 2023 and 2024, the VAT rate will be reduced to 8% for goods used in agricultural production, such as substrates and soil improvers.

Counterparties registered as VAT payers should also ensure that they are assigned a VAT number necessary to make international transactions.

What is a VAT number in Poland?

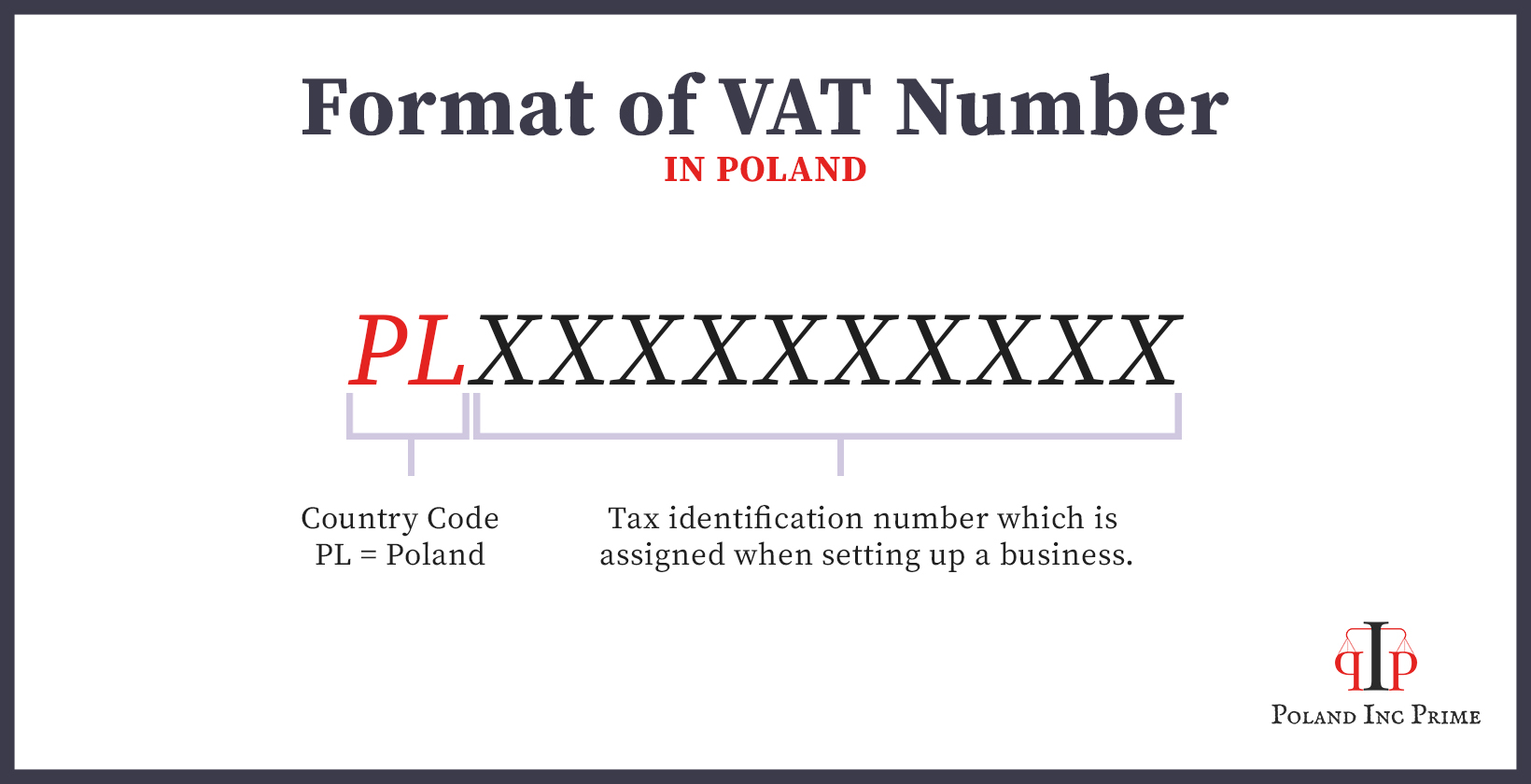

The VAT number is the Polish Tax Identification Number (Numer Identyfikacji Podatkowej, NIP) prefixed with the country code PL if the company is registered in Poland. VAT number’s format always starts with PL followed directly by 10 digits. Businesses trading internationally must include the VAT-EU number on invoices, recapitulative statements and other transactional documents. For domestic purchases, the NIP suffices, although adding the VAT number will not be a mistake.

Is the Polish NIP number the same as the VAT number?

Yes, the Polish NIP number, which is Tax Identification Number (Numer Identyfikacji Podatkowej) is the same as the VAT number assigned after registration as a VAT payer. It is an entrepreneur’s ID used to identify them in domestic and foreign trade. The only difference is the default format required in documents, as the NIP number is formatted as a string of 10 digits, for example PL1234567890. For VAT, prepend PL.

When issuing any business documents regarding transactions or even arrangements between contractors, it is worth providing the VAT number on each document.

How to register a company for VAT in Poland?

To register for VAT when operating a business in Poland, you need to perform 3 steps.

- Determining the competent authority for registration.

- Submission of a registration application.

- Payment of registration confirmation.

Determining the competent authority for registration is based on company headquarters in the case of companies which are legal persons, and on the place of residence in case of sole proprietorships, or on permanent place of business in case of companies not based in Poland.

Submission of the registration application requires filling in a VAT-R form. On the form, select whether the registered taxpayer will be an active or exempt taxpayer. In the case of an exempt taxpayer, submitting a declaration is not necessary, but it can be done voluntarily and it is worth doing it in the event of a suspicion of exceeding the sales value of PLN 200,000 in the tax year or selling goods or services listed in the VAT Act. The application is submitted in person, by post or electronically on biznes.gov.pl portal.

Payment of the confirmation of registration is not a necessary condition, however, if you want to have an official confirmation of registration as a VAT payer, you must pay a fee of PLN 170. The payment should be made to the account of the city or commune office competent for the tax office where the registration application was submitted. Failing to register a company for VAT in Poland despite the obligation results in a fine.

After being registered and approved as a VAT taxpayer, it is mandatory to set up a record of purchases and sales, as well as submit JPK and VAT returns to the tax office. The tax payment should also be made by the 25th day of the month following the month in which the tax obligation arose.

With every VAT settlement, there is a tax to be paid or refundable excess.

What is a VAT refund in Poland?

A VAT refund in Poland is a process of reclaiming the value-added tax paid on goods or services purchased in Poland. The value of the tax refund is determined on the basis of a monthly or quarterly JPK file. The VAT refund is calculated as the input-output tax difference.

To calculate a VAT refund in Poland, summarize VAT payable from the issued invoices and deduct VAT from the summarized purchases. For example, for a total of PLN 5,000 net in a given month taxed with 8% VAT, the tax payable in Poland is 400 Polish Złoty. For purchases of PLN 5,000 taxed with 23% VAT, the tax deductible is calculated by subtracting from the paid amount the quote divided by 1.23, which results in 935 Polish Złoty. The final quote of VAT is the difference between the tax deducted and paid that results in 535 Polish Złoty to be refunded by the Tax Office.

Who can get a VAT refund in Poland?

A VAT refund in Poland can be obtained by any entrepreneur who proves that he paid more VAT in purchase invoices than he received in sales invoices in a given month.

How to get a VAT refund in Poland?

In order to obtain a tax refund in Poland, it is necessary to demonstrate the surplus of input tax over output tax in the JPK settlement, and to indicate to the Tax Office how the refund should be paid.

Indicate to the Tax Office of Poland the method of settlement of the return by choosing one of the methods, as the money will be recovered to the indicated bank account or the surplus amount will be transferred to the next billing period.

When choosing a refund to a bank account, you should remember about the deadlines within which the legislator must pay the refund value, it is 25, 60 and even 180 days.

Due to the long deadlines, many taxpayers decide to transfer the surplus to the following months, thanks to which, if in the next settlement period the output tax is higher than the input tax, the transferred refund will reduce the liability to pay.

An intermediate solution is to transfer part of the amount to be refunded to a bank account, and transfer part of it to future liabilities.

What is a split VAT payment in Poland?

Split VAT payment in Poland is a method of paying invoices, which separates invoice amounts. The net amount goes to the main account, and total VAT goes to a linked VAT account.

The split payment mechanism was introduced on July 1, 2018. Initially, it was not mandatory, but from November 1, 2019 it is mandatory for invoices over PLN 15,000, which relate to goods and services listed in Annex 15 to the VAT Act. Each contractor issuing invoices for amounts above PLN 15,000 should read this appendix, because it is the seller’s responsibility to inform the customer on the invoice that it should be paid using the split payment mechanism (Mechanizm Podzielonej Płatności, MPP).

Using split payment is voluntary for invoices for goods and services listed in the Annex 15 to the VAT Act, which amount to less than PLN 15,000. The seller should include information about the split payment mechanism on the invoice, then the buyer should comply with this provision, although they will not be subject to any penalties for failure to comply with this information. Similarly, invoices for goods and services outside the catalog can be paid using split payment, but the suggestion of this type of payment should not be included in the invoice.