Costs of Opening a Company in Poland

The costs of opening a company in Poland are lower than in most neighboring countries due to the relatively low value of the Polish zloty compared to Euro. Opening a sole proprietorship in Poland requires no registration fees. The registration of a limited liability company in Poland requires creation of an entry to a National Court Register (Krajowy Rejestr Sądowy or KRS), which costs a maximum of PLN 500, an equivalent of €110 or $115.

The first investments in a newly opened company include registration costs, the value of the contributed share capital, as well as notary fees, office, bank fees, hiring and training employees.

The costs depend on the choice of the type of company, the decision on the quality of equipment necessary for the operation of the business, and even the method of handling matters, because some formalities completed online are cheaper or free of charge.

Table of Contents

How much does it cost to open a company in Poland?

The cost to open a company in Poland ranges from €600 to €4850 (zł2,774 – zł22,430 or $628 – $5,079) depending on the type of company.

Registration fees and the value of the share capital required to be paid when starting a company are also clearly defined in the regulations and depend on the type of business chosen.

Is there a difference in registration fees according to the type of Polish company?

Yes, there is a difference in registration fees for different types of companies in Poland. A sole proprietorship requires a minimum of formalities, so costs will be lower than in the case of a complicated joint-stock company. The cost of registration of a joint-stock company includes the cost of entry in the National Court Register and the notary fee, which in total amounts to up to PLN 1,000. These costs are not required in the case of a sole proprietorship.

The initial capital payment is also a major cost when starting a company. Depending on which of the eight types of business the entrepreneur chooses, whether it will be a limited liability company, joint-stock company, limited joint-stock partnership, sole proprietorship, limited partnership, civil partnership, general partnership or professional partnership, the value of the minimum amount of capital will vary, and in some it will not occur at all.

What is the minimum share capital for a limited liability company in Poland?

The minimum share capital for a limited liability company is PLN 5,000, which is approximately €1,080 or $1,155.

Due to the low required initial capital, a limited liability company (in Polish “Spółka z ograniczoną odpowiedzialnością”) is one of the most frequently chosen forms of business in Poland. The amount of minimum capital is contributed in the form of cash, in-kind or in-kind contributions.

The value of this amount is the entire amount that must be covered when establishing a limited liability company; the more partners the company gathers, the lower the cost for one partner will be.

What is the minimum share capital for a joint-stock company in Poland?

The minimum share capital for a joint-stock company is PLN 100,000, an equivalent of approximately €21,500 or $23,200.

In a joint-stock company (in Polish “Spółka akcyjna”) the amount of capital is contributed in a form other than cash, e.g. by transferring real estate or a car. You can also transfer part in one form and part in another. For example, one partner of a joint-stock company is allowed to transfer the property in the form of a parking space worth 20% of the minimum contribution, the other will deposit 80% in cash.

What is the minimum share capital for a limited joint-stock company in Poland?

The minimum share capital for a limited joint-stock partnership is PLN 50,000, which is approximately €10,800 or $12,600.

This value is the minimum amount for a limited joint-stock company (“Spółka komandytowo-akcyjna”) in Poland. You can deposit a larger amount than the required minimum. However, it is worth noting that the financial liability is up to the value of the paid-in capital.

Is there a minimum share capital for a sole proprietorship in Poland?

There is no minimum share capital for a sole proprietorship in Poland. The law does not impose any minimum rates for securing a sole proprietorship.

An individual running a sole proprietorship (in Polish “Jednoosobowa działalność gospodarcza”) is liable for the company’s obligations with all his or her personal property.

Is there a minimum share capital for a limited partnership in Poland?

There is no minimum share capital for a limited partnership (“Spółka komandytowa” in Polish). In the case of this type of company, one person is liable for the entire obligation of the company, and the other partners only up to the amount specified in the agreement.

Is there a minimum share capital for a civil partnership in Poland?

There is no minimum share capital for a civil partnership (“Spółka cywilna” in Polish). All members of the company are jointly and severally liable for the company’s obligations, but the company agreement limits the amount of liability to the value of the company’s own contribution. This takes away some of the responsibility, but the percentage of paid-in capital compared to the other partners also matters when dividing profits. Therefore, it is worth considering whether it is worth taking the risk and what amount of your own contribution will be reasonable.

Is there a minimum share capital for a registered partnership in Poland?

There is no minimum share capital for a registered partnership in Poland (“Spółka jawna”, abbreviated as Sp.j.). Partners are jointly and severally liable with their personal assets, and there are no limits to liability up to the amount of the initial contribution.

Is there a minimum share capital for a professional in Poland?

There is no minimum share capital for a professional partnership in Poland (Spółka partnerska). Each member decides for himself what amount he wants to allocate to the share capital.

Is it cheaper to start a business in Poland online or in person?

It is cheaper to start a business in Poland using an online system. Establishing a sole proprietorship is free of charge, both online, using (Centralna Ewidencja i Informacja o Działalności Gospodarczej, CEIDG) and in person, by visiting a respective city hall or a municipal office. The only optional cost is appointing a representative if the entrepreneur needs to delegate opening of the business.

Company incorporation for a limited liability company online costs 250 PLN, an equivalent of $57 or €54, while doing it in a traditional way costs 500 Polish Złoty or $114 or €108, which include registration in a National Court Register (KRS) plus 100 PLN for the obligatory public announcement in Monitor Sądowy i Gospodarczy (MSiG).

Even if the cost of the registration fee is the same online as in person, submitting it online saves time and costs of traditional post.

What are the additional costs for Polish companies?

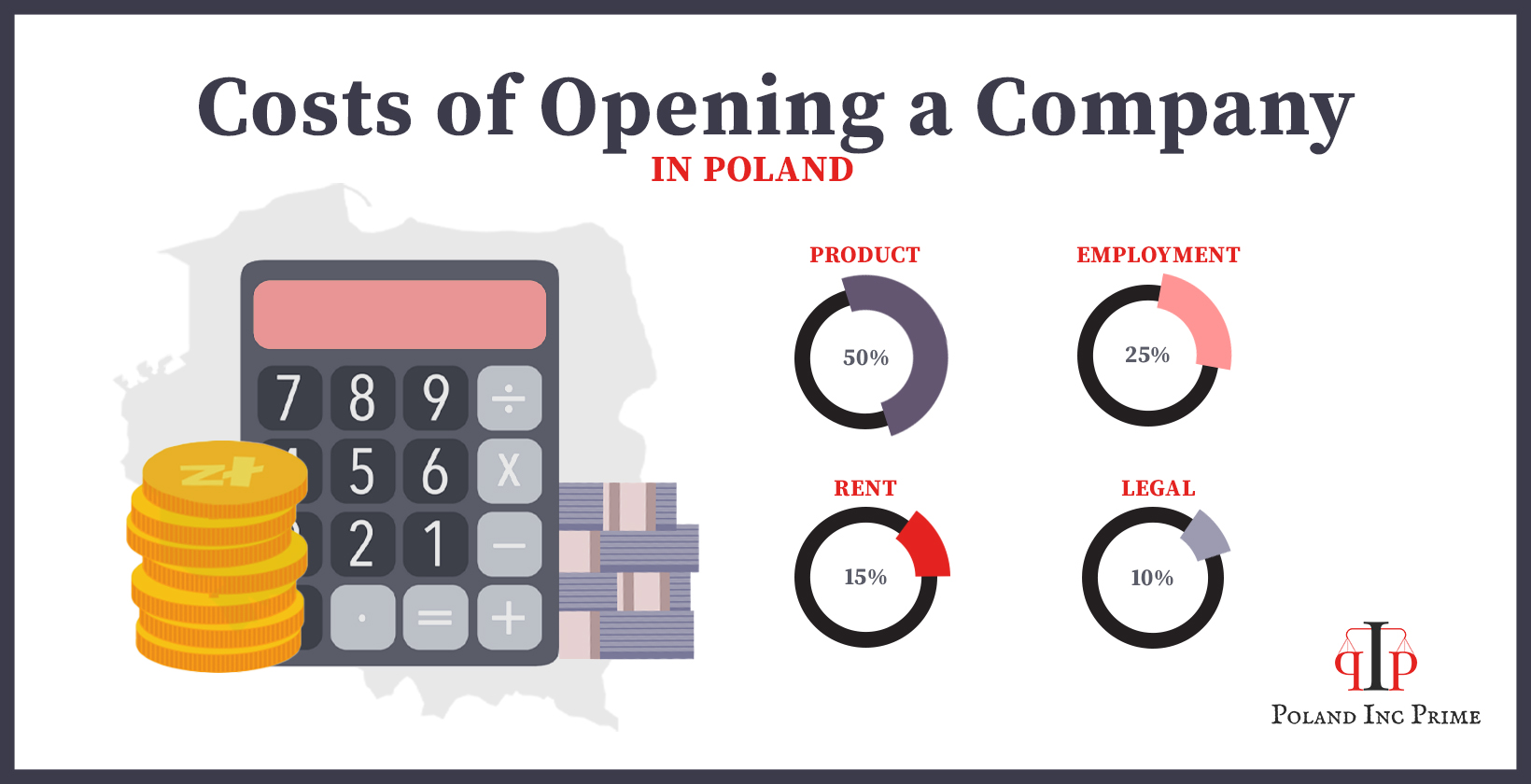

Additional costs for Polish companies starting their operations are notary fees, and the cost of renting an office, a physical or virtual one, as well as hiring and training employees.

Notary fees in Poland are connected with establishing a limited liability company, and are dependent on the amount of the share capital. For the share capital of PLN 5,000, which is an equivalent of $1150 or €1087, the notary fee is PLN 195 net/$45 /€42.

The cost of renting an office in Poland ranges from 39 PLN for a virtual office in a smaller town to 120 Polish Złoty, an equivalent of 26 Euro/$28 per month for a square meter of a physical office in Warsaw city center.

Hiring costs in Poland start from 21 PLN/ca. €4,57/ $4.88 per hour net for a minimal payment required by the Polish law, and goes up to 200 PLN/ €44/ $47 for an experienced manager or IT senior developer.

How much are the bank fees for companies in Poland?

Bank fees for companies in Poland range from 0 Polish Złoty for sole proprietors who are allowed by law to use their personal accounts for business purposes, to 100 PLN (€22, or $23) of a basic monthly fee for companies registered as legal persons.

Polish limited liability companies, civil partnerships and general partnerships are additionally charged by banks with transfer fees (starting from ca. 1,5 PLN, or €0.3 , or $0.3 for domestic transfers), and a cash withdrawal from an ATM (usually 1 – 3% of the withdrawal value). Each bank individually sets the rates for individual transactions and even negotiates individual clients. The total amount of additional bank costs in Poland depends on the number of transactions performed, as well as the use of special services, such as e-mail or written transfer confirmation or SORBNET transfers.

Bank fees in Poland do not need to be transferred, the bank collects them independently once a month or up to a few days after special transactions, such as cash withdrawal.

How much is the cost for entry into the National Court Register?

Entry into the National Court Register of Poland is specified in the regulations and amounts to PLN 500 ($116 or €109) for sole proprietorship and PLN 250 ($58 or €55) for general partnerships, limited partnerships, limited liability companies whose contracts were concluded using contract templates available in the ICT system.

Each change in the Polish National Court Register also involves a fee, for example changing the name of a partner costs PLN 350 ($81 or €76).

What is the fee for a Polish VAT number?

The fee for a Polish VAT number is free (0 PLN). The only amount when submitting an application for a VAT number is the fee for the PPS-1 special power of attorney worth 17 PLN (approximately $4 or €4).

Just like the above-mentioned power of attorney, introducing a company to the market involves some additional costs, such as accounting fees or a virtual office.

How much are the accounting fees for companies in Poland?

Accounting fees for companies in Poland range from 49 Polish Złoty (approximately $11 or €11) for self-served online accounting platforms available for sole proprietorships, to 600 PLN (approximately $140/ €130) and more for a middle sized limited liability company. The value of the final amount to be paid depends on many factors, including the method of accounting, the number of invoices to be settled, and the value of the company’s revenues.

It is worth comparing the offers of different accounting offices or individual accountants, because the market is quite large, and only comparison will allow you to choose the best offer. Some people, instead of deciding to outsource only accounting, outsource the running of the entire office virtually.

What is the cost for a company virtual office in Poland?

The cost of a company virtual office in Poland ranges from 39 PLN per month, an equivalent of $9 or €11, for a virtual office in a smaller town, to 300 Polish Złoty ($70, or €65) for an all-inclusive offer. The rate varies highly because it depends on how many tasks the entrepreneur outsources to the virtual office. You can pay for an address, only outsource handling emails and complaints, or outsource full accounting, administration, HR and payment processing.

By checking detailed offers of various Polish virtual office packages, you can decide whether extending the package will result in savings or whether it is better to delegate some of the tasks to an employee.